AI and data automation for strategic management of UTP/NPL portfolios

RESI’s Credit Intelligence solutions leverage AI and intelligent automation for large-scale financial data assessment, optimization of recovery strategies, and reduction of Due Diligence times. A data-driven approach that increases profitability and enhances operational transparency.

Key Solutions

Automated Data Assessment & Remediation

Data cleansing and validation without human intervention.

Dynamic Clustering

Automatic portfolio segmentation based on recovery priority.

Predictive Portfolio Analysis

Simulation of recovery scenarios using AI predictive models.

AI-driven Document Generation

Automatic creation of legal acts and documents.

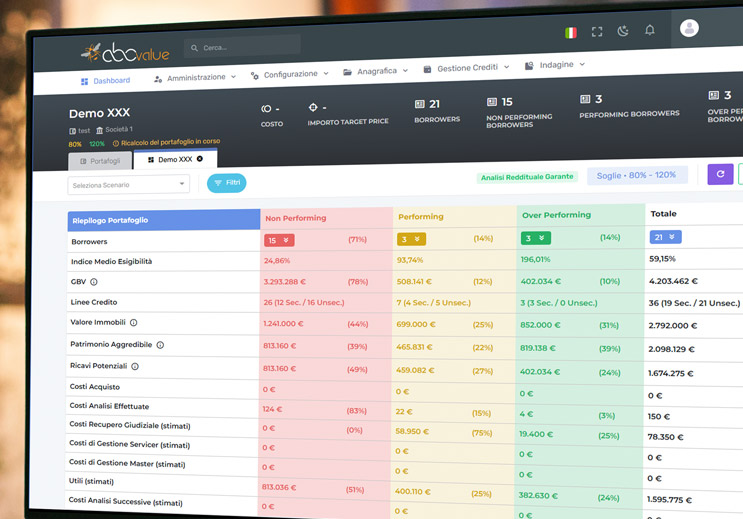

Real-time Dashboard

Monitoring of servicer performance and operational efficiency in real time.

ABC VALUE™ — Dedicated to credit intelligence

ABC VALUE™ is an AI-driven platform for Credit Intelligence that automates the analysis of UTP/NPL portfolios and accelerates Due Diligence and credit recovery with dynamic real-time dashboards.

RESi informaticaOur experts will help you find the solution that best fits your business

Do you need support to accelerate your business through digitalization and automation? Get in touch with us and we will design the ideal solution together.

Telephone

Our location

+39 06.927101

Mon. – Fri. 10:00 | 18:00

S.S. Pontina km 44,044

04011 Aprilia LT – Italy

Social network

Request Information

Define your objectives and indicate your areas of interest. Fill out the form below and our team will get back to you as soon as possible.