Key Features

- Data Automation — Automatic enrichment of property and credit information, reducing time and errors.

- Accurate Property Valuation — Market value estimation using advanced models and up-to-date auction data.

- Additional Asset Research — Identification of recoverable assets to maximize credit recovery.

- Automated Data Assessment & Remediation — Verification and cleansing of data without human intervention.

- Dynamic Clustering — Portfolio segmentation for targeted recovery strategies.

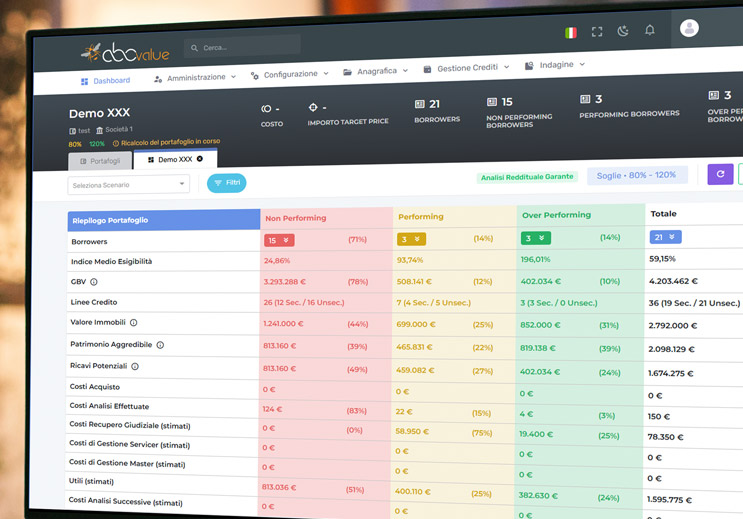

- Real-Time Dashboards — Operational control over servicer performance and portfolio progress.

- Recovery Strategy Simulation — Predictive tools to optimize timing and resources.